Are AI in Recruiting Acquihires Screwing Up the Startup Space?

In the rapidly evolving landscape of artificial intelligence, the intersection of talent acquisition and startup dynamics is creating waves that demand our attention. A recent high-profile example is Google's $2.4 billion acquihire of AI coding startup Windsurf—a deal that was originally poised to be a $3 billion acquisition by OpenAI but dramatically unraveled. This story, brought to light by The AI Daily Brief, offers a compelling window into how AI in recruiting and startup acquisitions are reshaping the industry, with far-reaching implications for employees, investors, and the future of innovation.

Understanding Windsurf and the AI Coding Boom

Windsurf has emerged as a leader in the AI coding assistance space, a sector that has rapidly become the hottest in AI this year. To put it in perspective, imagine a spectrum where Bolt and Lovable cater to less technical users with vibe coding platforms, while Cursor targets knowledgeable programmers with AI coding assistants and integrated development environments (IDEs). Windsurf aligns closer to Cursor’s end of the spectrum, focusing on sophisticated AI tools for expert programmers.

The distinction between vibe coding platforms for non-technical users and advanced AI coding assistants is blurring, and every major AI lab feels a pressing urgency to establish their own AI coding platform. This urgency is driven by the recognition that AI coding represents the biggest land grab in AI use cases since the chatbot explosion following ChatGPT’s launch.

OpenAI’s Initial Attempt and the Windsurf Acquisition Saga

OpenAI prioritized AI coding tools early on. After announcing their own tool, Codex, they looked to accelerate their position by acquiring an established player. In May, news broke that OpenAI had agreed to purchase Windsurf for $3 billion. This move was strategic, aiming to combine Windsurf’s existing product, user base, and talent with OpenAI’s resources.

Prior to the Windsurf deal, OpenAI had also tried to acquire Cursor, underscoring how competitive and valuable this AI coding niche has become. Windsurf reportedly grew to $100 million in annual recurring revenue (ARR) and was seeking further funding at a $3 billion valuation. Yet, the environment was challenging with pressure from vibe coding insurgencies, rival agentic IDEs, and hyperscalers who both power and compete with these platforms.

The Anthropic Clause and Rising Tensions

In early June, the landscape shifted when Anthropic cut Windsurf off from direct access to Claude models, a key AI technology. Anthropic’s cofounder Jared Kaplan stated that their priority was to serve customers who would sustainably work with them in the future, implying that selling Claude to OpenAI was not aligned with their goals.

Although Windsurf found a workaround through third-party access to Claude models, this strained the startup’s operational and financial resources. Meanwhile, the acquisition news stalled, and by mid-June, reports surfaced that the Windsurf deal had become a major sticking point in OpenAI’s negotiations with Microsoft.

Microsoft’s Role and the Collapse of the OpenAI Deal

Microsoft holds significant influence over OpenAI, especially regarding its conversion to a for-profit public benefit company. Microsoft reportedly insisted on retaining rights to all of OpenAI’s intellectual property, including Windsurf’s, if the acquisition went through. Windsurf’s leadership was uncomfortable with this demand, and in hindsight, Microsoft’s partnership with Replit on a vibe coding service signaled the deal was faltering.

When the exclusivity window on the OpenAI deal expired, Google seized the opportunity. The resulting arrangement was a $2.4 billion acquihire where Google hired Windsurf’s CEO Varun Mohan, cofounder Douglas Chen, and some R&D employees. Google licensed Windsurf’s IP but made no formal investment in the company, allowing Windsurf to continue operating independently.

The Human Cost: What the Deal Means for Windsurf Employees

While the deal might sound reasonable on paper, the fallout for Windsurf’s employees is stark and troubling. Natasha Moskarenas from The Information reported that employees with vested shares would receive cash payouts, but those who joined less than twelve months ago—thus not yet vested—would receive nothing. Windsurf negotiated to keep $100 million on its balance sheet, shifting focus to enterprise customers, with the remaining company becoming employee-owned.

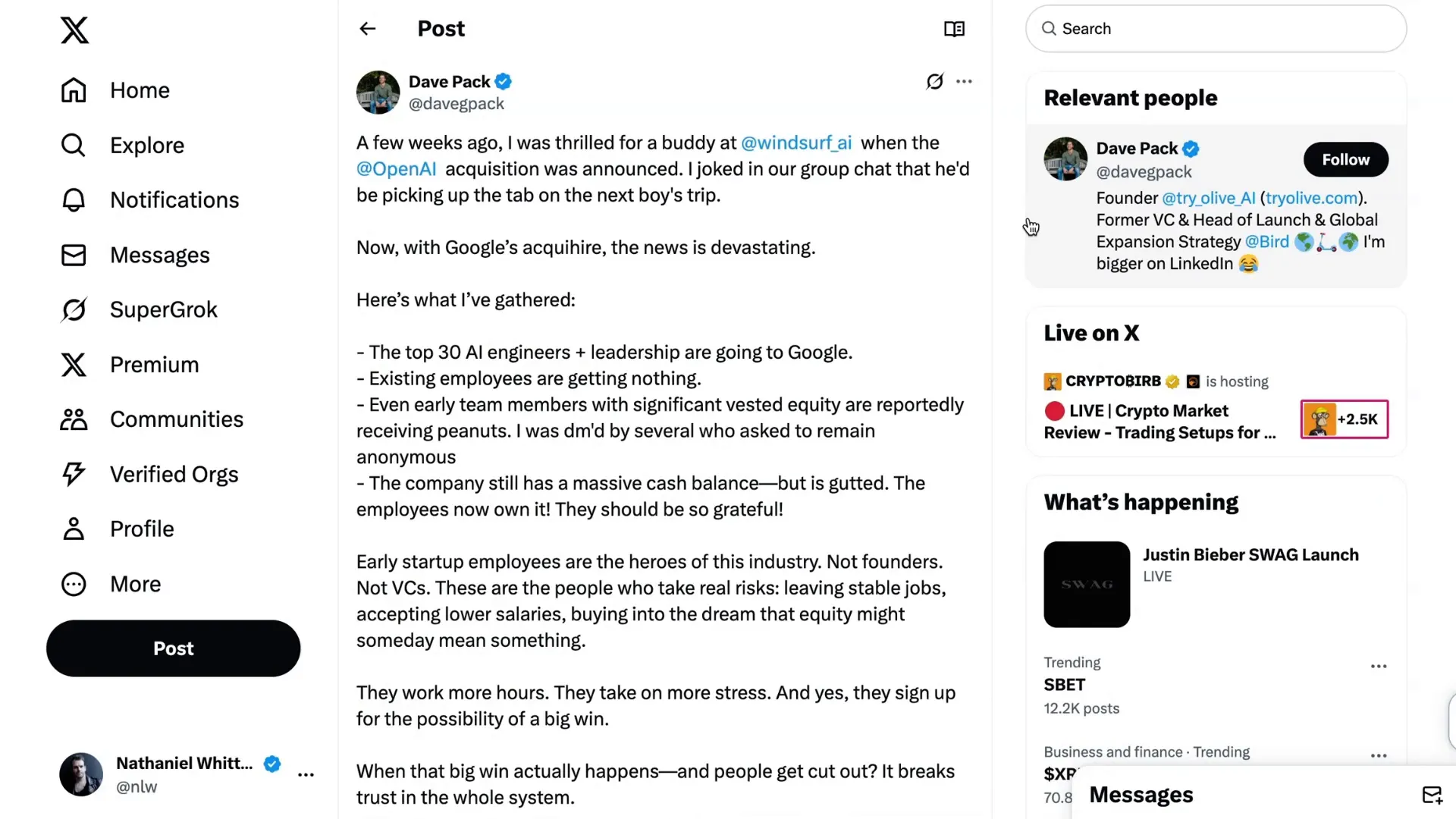

Entrepreneur Dave Pack shared a heartfelt perspective: early startup employees take significant risks, often accepting lower salaries and investing sweat equity with hopes of a big payoff. When a $3 billion-plus exit fails to benefit these employees, it breaks trust in the equity model that fuels startup culture. Dave called the acquihire “greed disguised as compliance,” warning that such deals could drive away mission-driven talent and leave startups staffed by mercenaries.

The Divide Between Founders, Investors, and Employees

Industry voices like Jordy Hayes of TVPN confirmed that the founders and a select group of engineers are going to Google and will share the headline $2.4 billion sum along with preferred shareholders. Meanwhile, hundreds of employees left behind—vested or not—appear to be receiving little to no compensation. The consolation prize for those remaining is ownership of the original Windsurf company, which is expected to struggle against fierce competition, including from the very founders now at Google.

Windsurf’s leadership framed this as a win for those staying behind, citing continued revenue and a solid balance sheet. However, given Google’s license to Windsurf’s core technology, industry insiders predict the company’s decline and eventual bankruptcy within a year.

Industry Perspectives and the Larger Trend of Blitz Hire Acquisitions

This deal is not an isolated incident. Similar patterns have emerged with Scale AI’s stake sold to Meta, Google’s deal with Character AI, Microsoft’s licensing of Inflection’s models, and Amazon’s acquihires of Adept and Covariant. These “blitz hire” acquisitions typically involve acquiring leadership and key talent while leaving a shell company behind, often struggling to survive.

Billy Icheff of Category VC coined the term “blitz hire acquisition” to describe this emerging trend. Unlike traditional acquisitions that buy entire companies outright, blitz hires focus on speed, circumventing antitrust reviews and enabling immediate onboarding of key employees. While this approach accelerates talent acquisition, it comes at a cost to the broader ecosystem.

Regulatory Pressures and Market Dynamics

Many investors blame aggressive antitrust enforcement under former FTC chair Lina Khan for driving companies toward these unconventional deals. Martin Casado of Andreessen Horowitz highlighted the irony that such activism may have worsened outcomes for all parties except the targeted tech giants. Still, some argue that the pace of AI advancement would have driven blitz hires regardless, as waiting for traditional approvals could delay critical hires by up to a year—a lifetime in AI development.

However, critics like Sophie at Netcap Girl warn that broken M&A processes hurt the entire tech ecosystem by undermining healthy capital markets, which are essential for innovation.

The Future of Talent, Equity, and AI in Recruiting

John Lettig from Founders Fund offers a broader view, suggesting that just as a small percentage of startups generate most venture returns, a similar “power law” is emerging among individual engineers. The hypercapitalist AI talent wars are reshaping employment contracts, investment norms, and the concentration of returns. Lettig predicts a future where labor agreements resemble those in sports or entertainment, with substantial repricing of talent and more competitive hiring dynamics.

These shifts have profound implications for AI in recruiting. Companies must rethink how they attract, retain, and reward AI talent, balancing speed, fairness, and long-term sustainability. The Windsurf acquihire serves as a cautionary tale, highlighting the risks when short-term deal structures sacrifice employee trust and equity value.

What This Means for OpenAI and the Broader AI Ecosystem

OpenAI, at the center of this talent war, faces mounting challenges—from Meta’s competitive moves to complications with Microsoft and losing out on the Windsurf deal. These dynamics underscore the hypercompetitive nature of AI development and the high stakes involved in securing top talent and intellectual property.

While the ultimate outcomes remain uncertain, one thing is clear: the traditional expectations of startup exits, employee equity, and acquisition structures are being upended. The Windsurf story is a vivid example of how the rules of the game are changing in AI recruiting and startup ecosystems.

Conclusion: Navigating the New Reality of AI in Recruiting and Startup Acquisitions

The Windsurf acquihire by Google reveals a complex web of corporate strategy, regulatory challenges, and human impact. As AI continues to reshape industries, the methods companies use to acquire talent and technology will evolve—sometimes in ways that strain longstanding norms of fairness and trust.

For founders, investors, and employees alike, this is a wake-up call. The model of rewarding early employees with meaningful equity stakes must be preserved to sustain innovation and motivation. Otherwise, startups risk becoming transactional workplaces devoid of the passion and mission that fuel breakthrough technologies.

As we watch these developments unfold, it’s vital to remember that behind every headline deal are real people whose careers and livelihoods are at stake. Balancing speed, competition, and equity in AI in recruiting is one of the defining challenges of this new era.

For those interested in the ongoing discourse on AI, startups, and talent acquisition, this story offers invaluable lessons and a glimpse into the future of technology and work.