Jul 9, 2025

Meta's Bold Move in AI Recruiting: Poaching Top Apple Talent Amid Soaring Costs

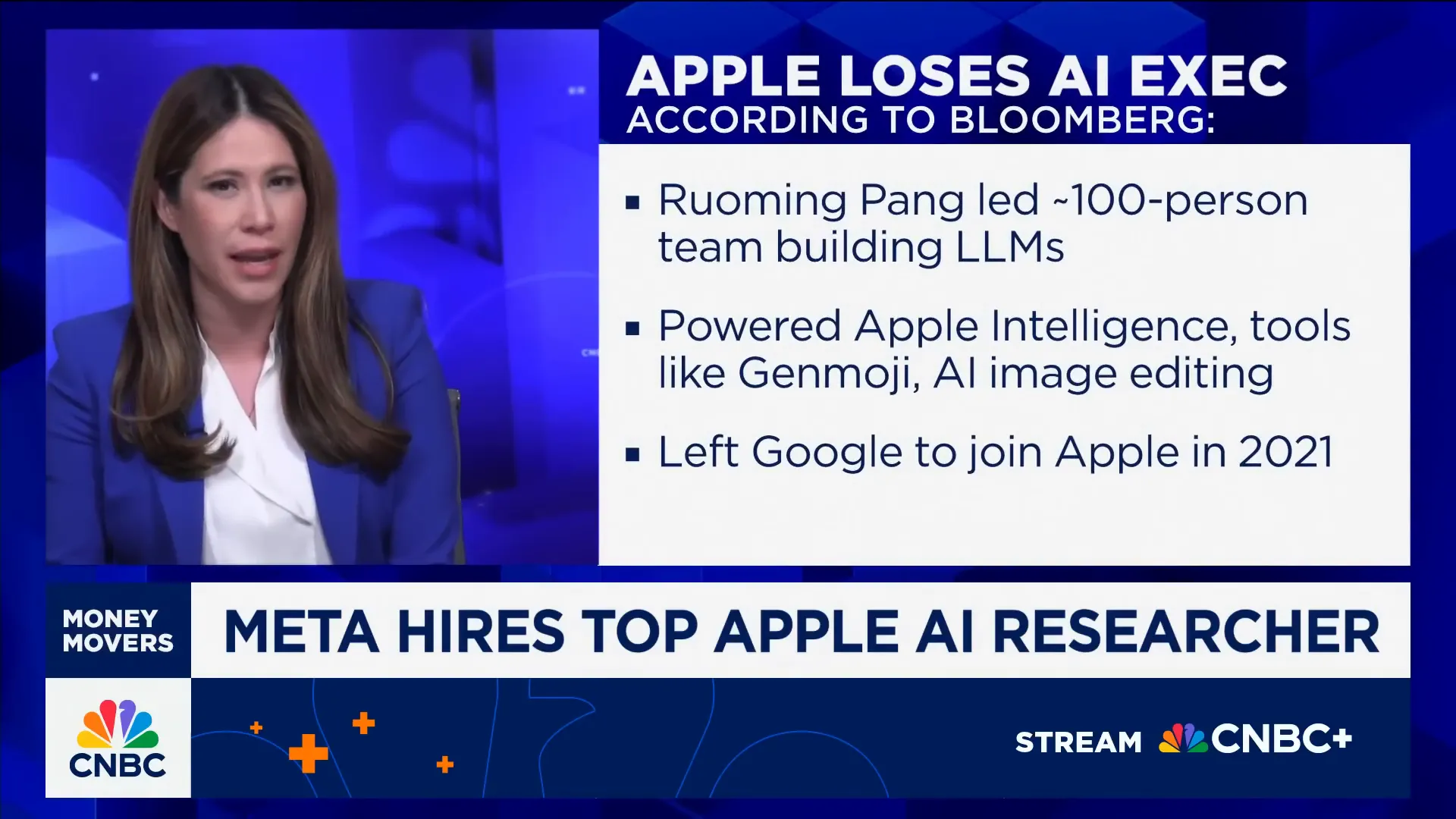

The landscape of artificial intelligence is evolving at a breakneck pace, and few companies are demonstrating as much urgency as Meta. In a recent and highly publicized move, Meta has secured one of Apple’s leading AI researchers, Roming Peng, reportedly offering tens of millions of dollars to bring him on board. This acquisition is part of Meta's aggressive strategy to dominate the AI space, not just by investing in hardware like GPUs but by aggressively recruiting top talent from competitors. This blog post dives deep into Meta’s current approach to AI in recruiting, the implications of its spending spree, and the broader questions around strategy and return on investment.

The Zuckerberg Steinbrenner Moment: Spending Without Limits

Wells Fargo has aptly dubbed this phase of Meta’s AI efforts as Mark Zuckerberg’s “Steinbrenner moment.” For those unfamiliar, George Steinbrenner was the legendary owner of the New York Yankees, known for spending whatever it took to build a winning team, famously writing blank checks to sign the biggest stars.

Similarly, Zuckerberg is not just investing heavily in the infrastructure needed for AI development but is also aggressively pursuing top-tier talent, regardless of cost. The latest jewel in this crown is Roming Peng, a researcher who previously worked at Google before leading a 100-person team at Apple focused on building large language models (LLMs) that power Apple’s AI efforts.

While Apple’s AI division has not always been considered the hottest hub for AI talent, Zuckerberg clearly saw something valuable in Peng that others overlooked. This move could be described as a pull from the minor leagues, but it’s a strategic play to capitalize on overlooked potential and secure a key player in the AI arms race.

Big Spending Doesn’t Always Guarantee Success

However, hiring marquee names alone doesn’t guarantee a smooth path forward. Talent without effective cohesion can quickly lead to chaos. Meta’s AI division has seen an influx of strong personalities, including Alexander Wang, Nat Friedman, and Daniel Gross. These leaders come primarily from the product side rather than academia, which is a notable shift in the company’s AI culture.

Alexander Wang, at just 28 years old, holds a position on par with or even above Yann LeCun, one of the founding fathers of deep learning and Meta’s long-time chief AI scientist. This hierarchy shift raises questions about the internal dynamics and whether the new leadership can effectively harness the collective expertise to build groundbreaking AI systems.

The Rising Costs of AI Talent and Infrastructure

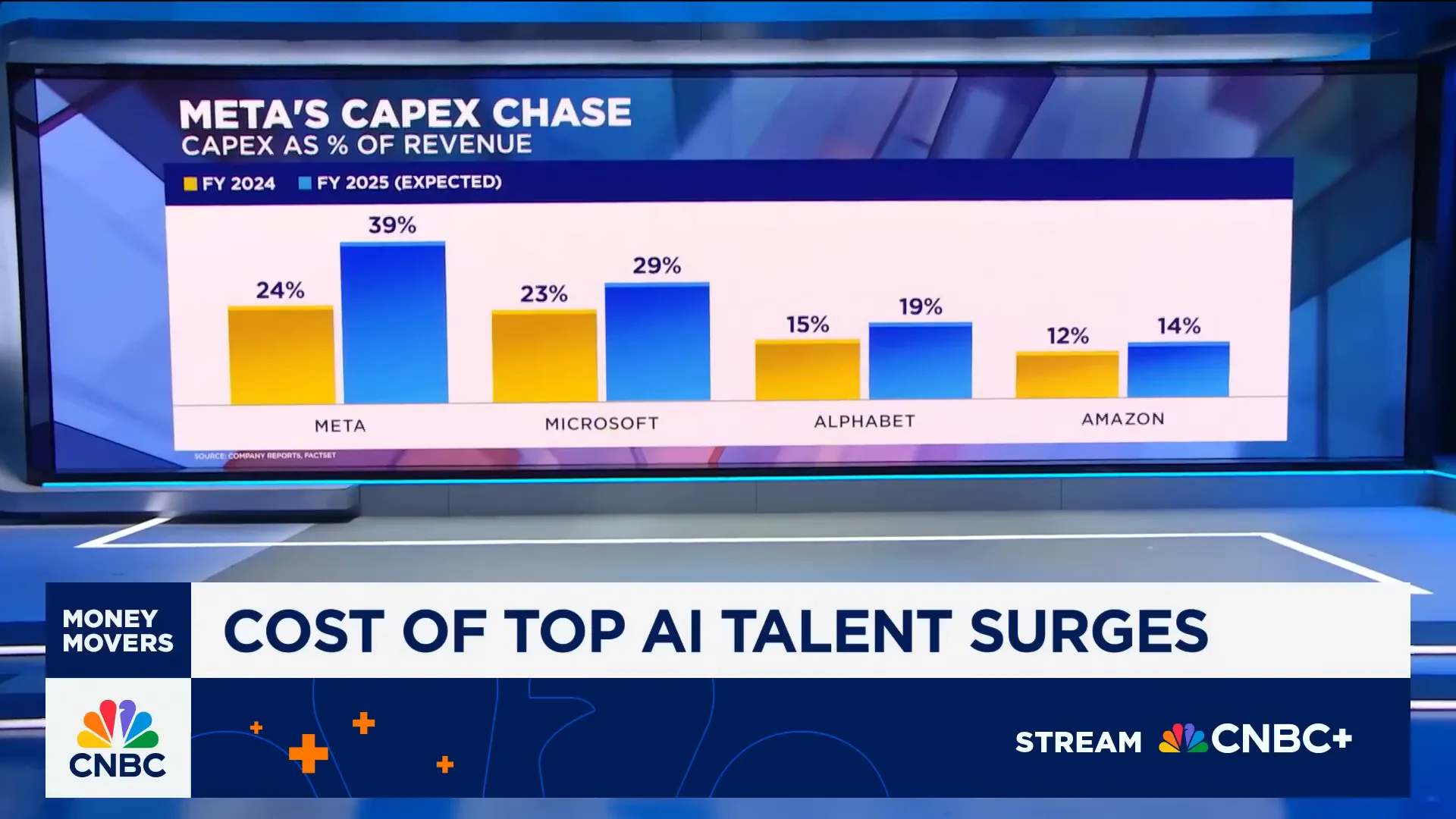

Meta’s spending on AI is not just about talent acquisition. Capital expenditures (CapEx) for the year are projected to exceed $70 billion, a figure that grows faster than even the hyperscalers who benefit from extensive enterprise cloud businesses. Wall Street estimates that the new AI hires alone may cost Meta between $1 billion and $4 billion this year.

Moreover, Needham analysts have noted that Meta’s stock-based compensation has tripled, now nearly three times the average across big tech firms. This swelling compensation package affects labor productivity metrics, with free cash flow per employee reportedly down by 30%. In simple terms, while the company continues its hunt for AI talent, overall labor productivity is shrinking.

Strategy or Second System Effect?

Investors and industry watchers are beginning to question whether Meta’s current trajectory is a well-calibrated strategy or falling prey to the “second system effect.” This pattern occurs when a team, after a successful initial build, overreaches on the next iteration by adding too many features or trying to solve every problem at once, ultimately losing the focus that made the original product successful.

Meta’s open-source success with LLaMA has been widely praised, but the company now seems to be throwing everything at the wall in hopes that something will stick. The jury is still out on whether this approach will coalesce into a coherent strategy or lead to fragmentation and inefficiency.

Questions Around Discipline and Cost Control

Historically, Meta has been recognized for its disciplined approach to capital expenditure, often coming in under its CapEx guidance over the course of a year. However, this year might be different. The rising costs and aggressive hiring spree raise questions about whether Zuckerberg’s renowned discipline is waning or if this is a calculated pivot to prioritize AI dominance over short-term efficiency.

There’s also ambiguity about whether the $1 billion to $4 billion in AI talent costs are fully accounted for in the total expenses for the year. This lack of clarity only adds to the uncertainty surrounding Meta’s financial outlook.

Investor Expectations: When Will the AI Investment Pay Off?

From an investor’s perspective, the timeline and tangible return on investment for these expensive AI hires are critical. The salaries and compensation packages being reported are substantial, and shareholders will want to see clear evidence that these investments translate into meaningful advancements or revenue growth.

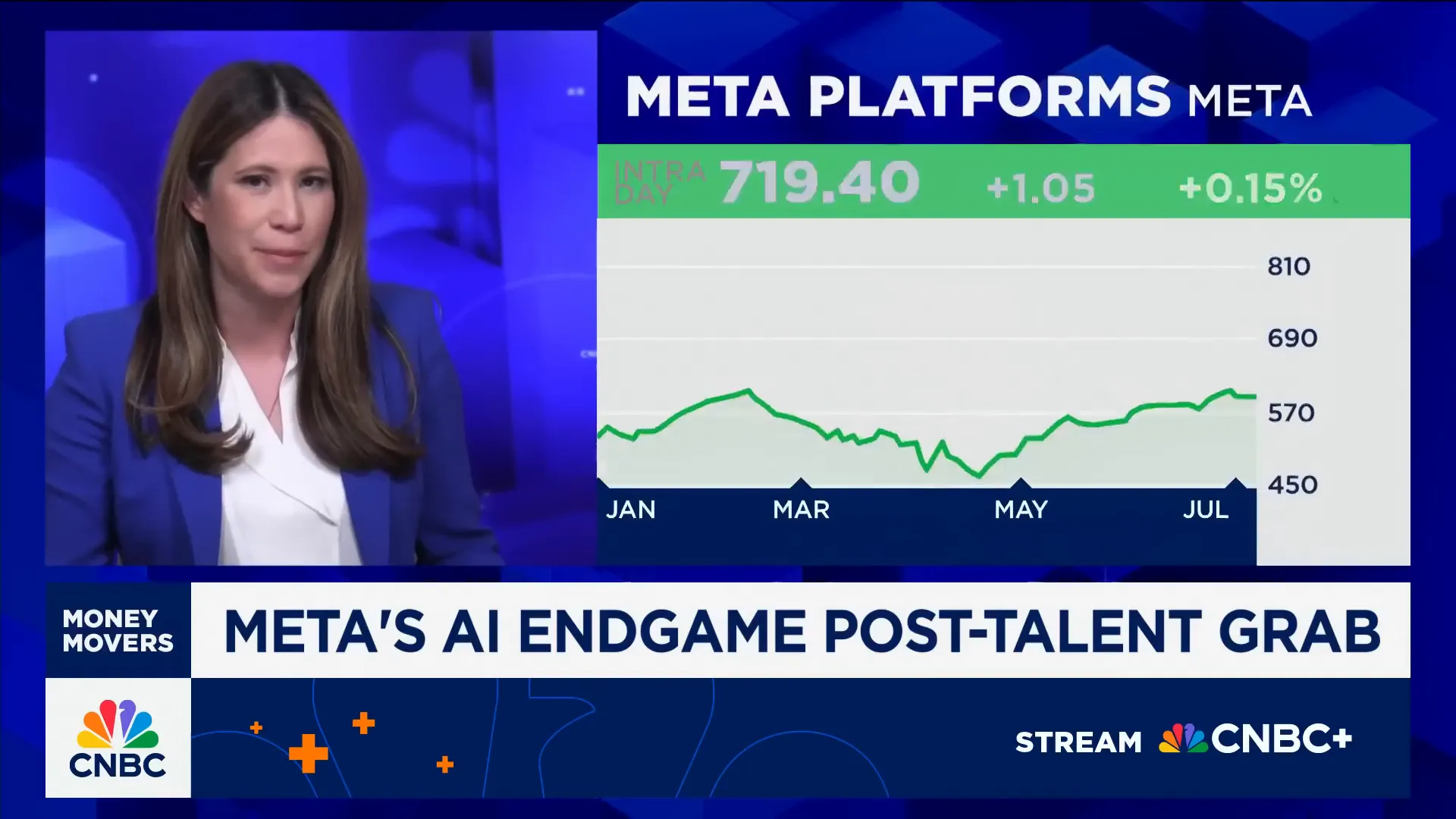

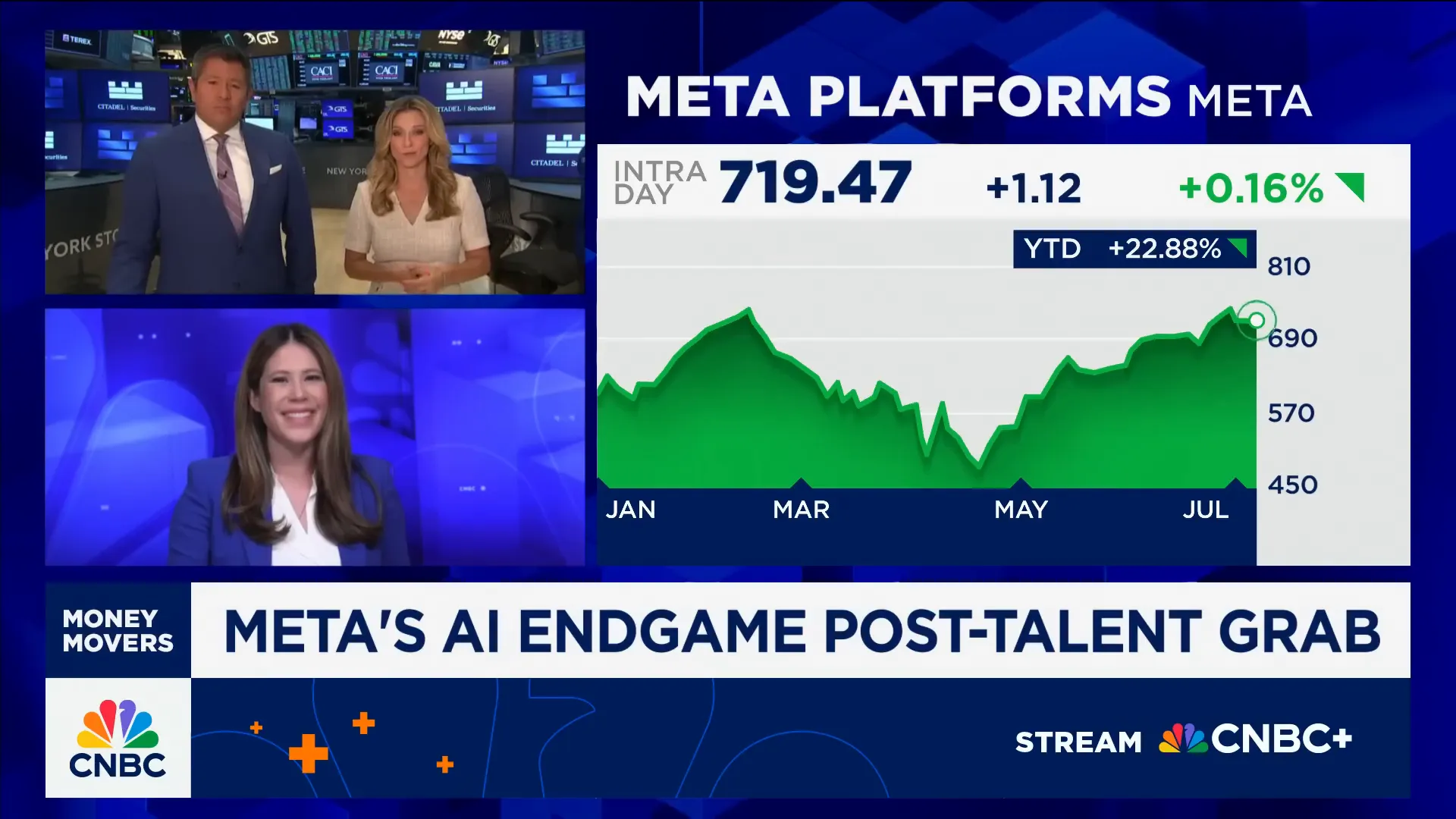

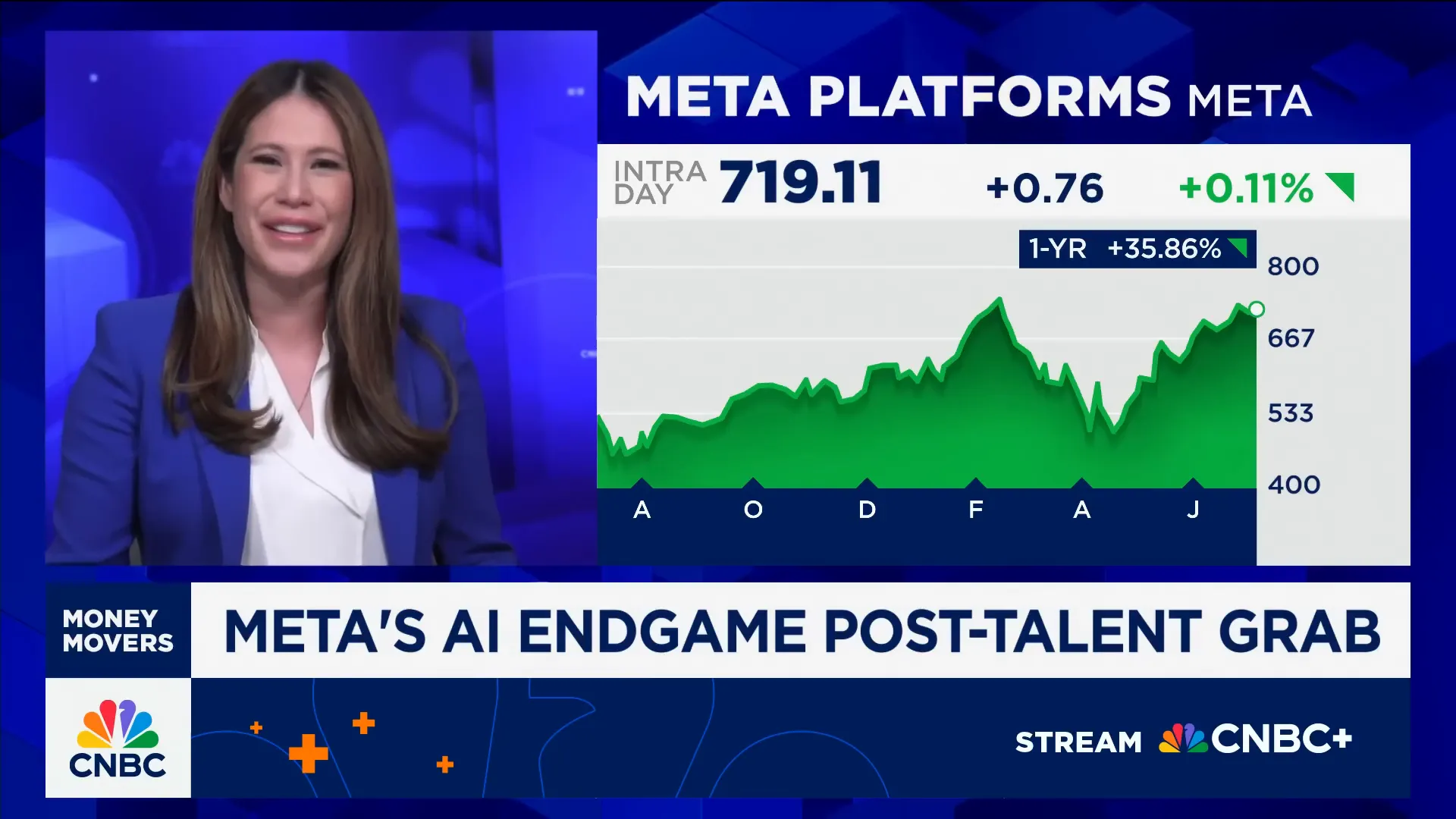

This creates a tension at the heart of the AI arms race: the balance between the hype and excitement of AI’s potential and the practical realities of generating ROI. Earlier this year, Meta’s stock experienced volatility partly because investors questioned the pace and scale of AI-related spending without clear payoff.

Unlike hyperscalers such as Amazon Web Services or Microsoft Azure, which can sell AI-powered cloud services to enterprises, Meta’s AI models primarily enhance its core social media and advertising products. This makes the path to monetization more complicated and less direct, adding to investor uncertainty about when the payoff will materialize.

Patience and Enthusiasm Still Abound in AI

Despite these challenges, the AI sector remains a hotbed of enthusiasm and patience. Unlike Meta’s earlier bet on the metaverse, which faced skepticism and slower adoption, AI is currently viewed as a transformative technology with vast potential. This has led investors to maintain a degree of tolerance for high spending and delayed returns.

Wells Fargo’s recent price target for Meta stands at $783, signaling confidence in the company’s long-term prospects despite near-term cost pressures. The broader AI excitement may provide Meta with the runway needed to refine its strategy and demonstrate the value of its aggressive recruiting and investment.

Conclusion: The High-Stakes Gamble on AI in Recruiting

Meta’s recent acquisition of Roming Peng and other top AI talent from Apple and beyond underscores the company’s commitment to leading the AI revolution. This aggressive approach to AI in recruiting is emblematic of Zuckerberg’s willingness to spend big to win big, echoing the Steinbrenner playbook of assembling star-studded teams.

However, with costs soaring and labor productivity metrics declining, the question remains: Is Meta executing a coherent strategy, or is it risking the pitfalls of overreach and loss of focus? Investors and industry observers will be watching closely to see whether these high-profile hires and massive investments translate into sustainable innovation and competitive advantage.

For now, the AI arms race is far from over, and Meta’s bold moves highlight both the promise and peril of pursuing technological dominance through talent acquisition. The coming months and years will reveal whether this gamble pays off or if the company needs to recalibrate its approach to balance visionary ambition with disciplined execution.