Jul 8, 2025

June Jobs Report Offers Surprise Hiring Bump: A Closer Look at the Latest US Jobs Update and Staffing Trends

The latest jobs report from June has brought unexpected optimism to the US labor market, defying earlier concerns about slowing growth and economic uncertainty. Despite challenges such as tariff-induced inflation fears and cautious employer sentiment, the June jobs report revealed stronger-than-anticipated hiring, highlighting the resilience of the staffing sector and the broader economy. This article provides a comprehensive analysis of the June jobs report, breaking down key data points, examining the implications for employers and job seekers, and exploring what this means for the future of US employment trends.

Introduction: Surprising Strength in the June Jobs Update

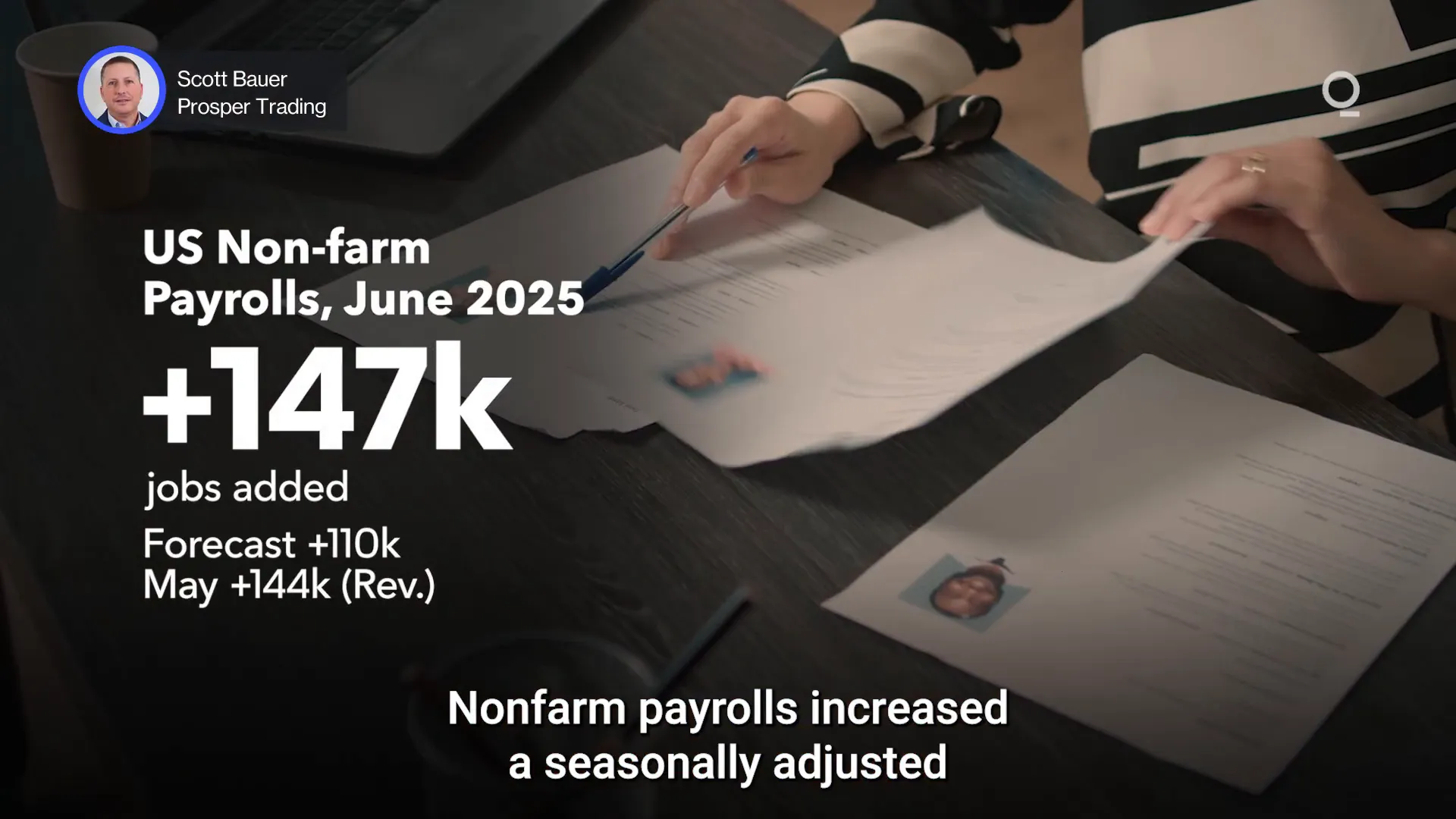

Last month, initial reports pointed to a slowdown in US job growth, with many analysts attributing this hesitation to tariff uncertainties and broader economic concerns. However, the revised data released in early July painted a more encouraging picture. June saw a notable bounce in hiring, with non-farm payrolls increasing by 147,000 jobs—significantly above the forecast of 110,000. This unexpected hiring bump indicates a labor market that continues to adapt and hold steady despite headwinds.

With the unemployment rate dropping to 4.1%, the lowest since February, and average hourly earnings rising, the June jobs report challenges previous narratives about a weakening job market. Yet, this positive news is nuanced by factors such as a decline in labor force participation and a substantial contribution from public sector hiring. In this article, we delve into the details of the report and what it means for businesses, workers, and policymakers.

Understanding the June Jobs Report: Key Highlights

Non-farm Payroll Growth Exceeds Expectations

The headline figure from June’s jobs report is the addition of 147,000 seasonally adjusted non-farm payroll jobs. This figure not only exceeded the consensus estimate of 110,000 but also signaled unexpected strength amid a backdrop of cautious economic forecasts. Non-farm payroll data is a critical indicator of overall employment health, covering all jobs except those in farming, private household, and nonprofit sectors.

However, it is important to note that about half of these new jobs were created by state and local governments rather than the private sector. Public sector hiring can sometimes reflect budget cycles or policy-driven employment rather than organic economic growth, which tempers the overall enthusiasm somewhat.

Private Sector Job Growth Slows

While the total payroll gain was robust, private sector job creation was more subdued, with only 74,000 new jobs added in June. This marked the smallest monthly increase in private sector employment in eight months, suggesting some hesitancy among private employers. Various factors could contribute to this slowdown, including tariff uncertainties impacting manufacturing and supply chains, cautious capital expenditures, and concerns about future economic growth.

This slowdown in the private sector is an important consideration for staffing agencies and recruiters, as it signals a more competitive and selective hiring environment. Companies may be prioritizing efficiency and skill-specific hiring over broad workforce expansion in the near term.

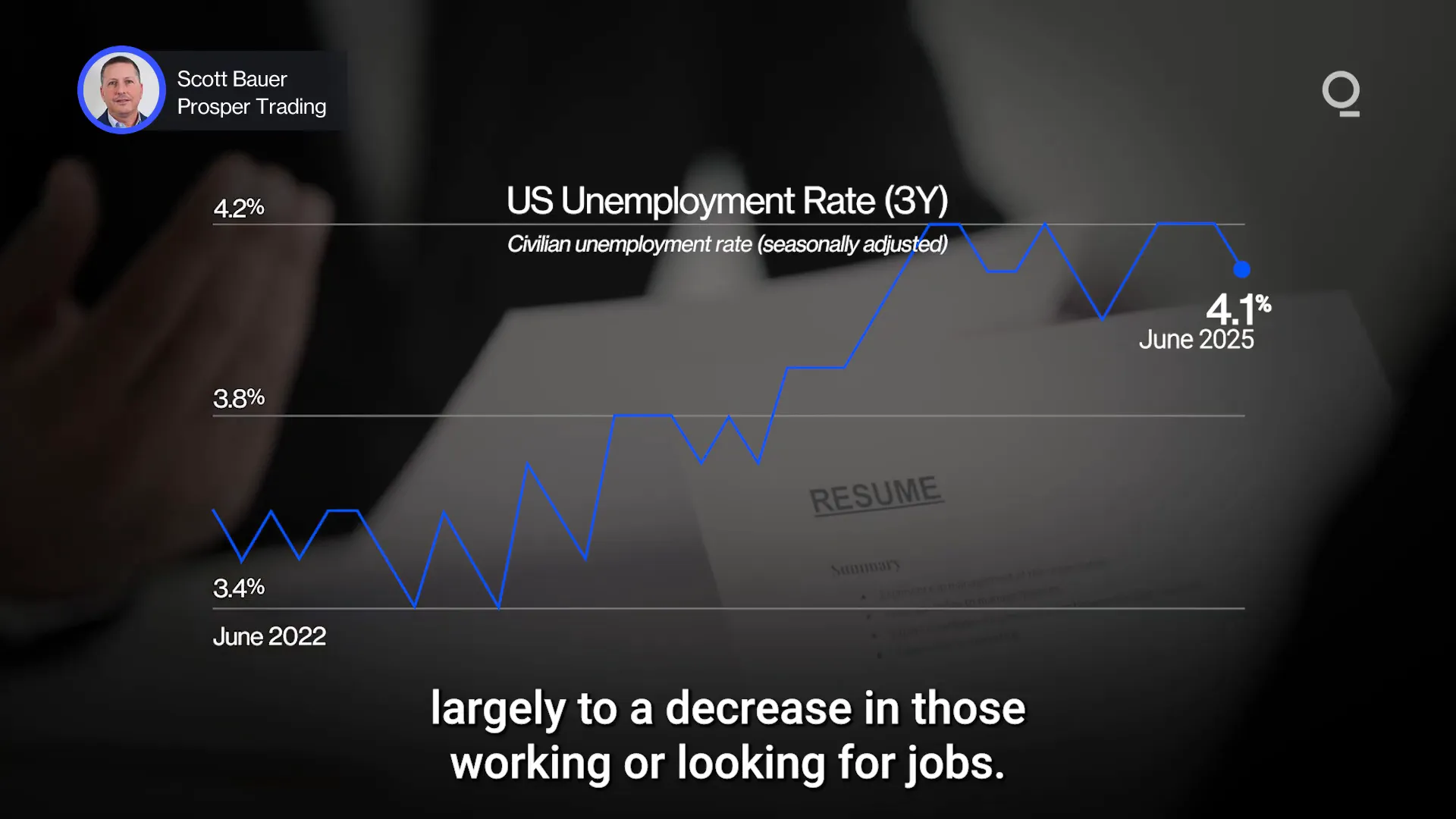

Unemployment Rate Drops to 4.1%

One of the most notable outcomes of the June report was the decline in the unemployment rate to 4.1%, the lowest since February. This was surprising given forecasts that predicted a slight increase to 4.3%. A lower unemployment rate generally suggests a healthier labor market with more people finding work.

However, this drop was largely driven by a decrease in the number of people either employed or actively seeking work. This phenomenon often results from discouraged workers exiting the labor force, rather than a surge in hiring. Therefore, while the unemployment rate fell, the labor force participation rate also declined, indicating fewer people are engaged in the job market.

Labor Force Participation Rate Declines

The labor force participation rate, which measures the percentage of working-age people who are either employed or actively looking for work, fell to 62.3% in June. This is the lowest level since late 2022. A declining participation rate can signal underlying challenges in the job market, such as discouraged workers, early retirements, or structural shifts in employment sectors.

For staffing firms and policymakers, this trend suggests that while headline job numbers look strong, the pool of available workers is shrinking, potentially leading to tighter labor markets and wage pressures in certain industries. It also underscores the importance of strategies to re-engage sidelined workers.

Wage Growth Remains Steady

Complementing the job growth and unemployment data, average hourly earnings rose by 0.2% in June, which translates to a 3.7% increase compared to a year ago. This steady wage growth is a positive sign for workers, indicating that employers are continuing to offer competitive pay, possibly as a strategy to attract and retain talent amid a tight labor market.

For recruiters and staffing agencies, wage growth is a double-edged sword. While it reflects healthier compensation trends for candidates, it can also increase costs for employers and influence hiring decisions, potentially slowing overall job creation.

Implications of the June Jobs Report for Staffing and Employment

Resilience Amid Economic Uncertainty

The June jobs report showcases the resilience of the US labor market despite ongoing economic uncertainties. Tariffs and inflation concerns had led many to expect a slowdown in hiring, but the labor market’s ability to absorb new workers and maintain wage growth suggests underlying strength.

This resilience is encouraging for staffing firms, as it indicates continued demand for talent across sectors, albeit with more nuanced shifts between public and private employment. It also reinforces the importance of agility in staffing strategies to navigate changing market dynamics.

Public Sector’s Role in Job Growth

The significant contribution of state and local government jobs to the overall payroll increase highlights the public sector's role in employment growth. This may reflect increased public investment or seasonal hiring patterns in education, healthcare, and municipal services.

Staffing firms serving public institutions or government contractors may find new opportunities in this environment. However, the reliance on public sector hiring also means that private sector job growth remains a critical barometer for economic health and staffing demand.

Challenges in Private Sector Hiring

The slowdown in private sector job additions signals caution among businesses. Factors such as tariff uncertainty, supply chain disruptions, and economic growth concerns are likely influencing hiring decisions. This environment requires staffing agencies to focus on high-demand skill areas and offer flexible staffing solutions that align with employer risk tolerance.

Labor Force Participation and Talent Availability

The decline in labor force participation raises concerns about the availability of workers. Employers and staffing firms may need to invest more in training, upskilling, and outreach to underrepresented or sidelined worker groups. Understanding the causes behind participation declines is crucial for developing effective recruitment and retention strategies.

Wage Growth and Its Impact on Staffing

Continued wage growth is positive for workers but presents challenges for employers looking to manage labor costs. Staffing agencies can play a key role by helping companies find the right balance between competitive pay and productivity, including through temporary, contract, and project-based staffing solutions.

Conclusion: Navigating the Current Jobs Landscape in Staffing

The June 2024 jobs report offers an insightful snapshot of the US labor market, marked by surprising strength but also nuanced challenges. The unexpected hiring bump, driven in part by public sector jobs, coupled with a declining unemployment rate and steady wage growth, signals a resilient economy adapting to uncertainty.

For staffing professionals, this environment underscores the need for strategic flexibility, deeper understanding of labor force dynamics, and a focus on matching talent with evolving employer needs. As labor force participation dips and private sector hiring slows, innovative approaches to recruitment and workforce management will be essential to capitalize on the opportunities this jobs update presents.

In the face of ongoing economic shifts, staying informed through detailed jobs reports and market analysis is critical. Staffing firms and employers alike should leverage these insights to refine their hiring strategies and support a robust, inclusive labor market moving forward.

For more detailed analysis and updates on US employment trends, visit Bloomberg News and explore the latest market insights presented by CME Group.