Is There an AI Bubble? Insights from the Latest AI Market Trends and Investment Strategies

Artificial intelligence continues to dominate headlines, especially with the recent launch of GPT-5, which has stirred significant conversations around the future of AI and its impact on markets. As discussions around AI in recruiting and other sectors heat up, it’s essential to understand the evolving perspectives on whether we are in an AI bubble or witnessing a sustainable technological revolution. This article dives deep into these changing conventional wisdoms, highlighting key market movements, investment insights, and why old market analogies might no longer apply in the face of AI’s rapid evolution.

Resetting Expectations: What GPT-5’s Launch Really Means

When GPT-5 launched, many anticipated it would mark the dawn of Artificial General Intelligence (AGI), a level of AI capable of human-like reasoning and understanding across various domains. However, the reality turned out to be different yet equally significant. Instead of signaling the immediate arrival of AGI, GPT-5 reset expectations among experts and investors alike. The buzz shifted from an imminent AI takeover to a more nuanced understanding that AI development is competitive and fast but not necessarily on a trajectory that will suddenly replace entire job categories overnight.

David Saxs, among others, has argued that the rapid takeoff narrative has been overstated. While AI models are undeniably impressive, their evolution is characterized by incremental advancements rather than sudden leaps that wipe out industries in one fell swoop.

Similarly, Adam Butler of Resolve Asset Management emphasized that AI’s progress isn’t a simple upward curve in pure model capacity. Instead, he points out that the real challenge lies in integrating these powerful models into the 80% of the economy that still relies heavily on traditional tools like Excel and email. This integration phase, while less glamorous than headline-grabbing breakthroughs, is where AI will truly begin to reshape industries.

Wall Street’s New Player: The Rise of AI-Driven Hedge Funds

The market’s perception of AI has shifted dramatically, as illustrated by a fascinating story about Leopold Ashen Brener, a 23-year-old former OpenAI researcher. Leopold launched a hedge fund named “Situational Awareness” that has raised an astonishing $1.5 billion and is currently outperforming the market by a wide margin.

Leopold’s journey began last summer when many analysts were skeptical about AI’s near-term market impact. Goldman Sachs, for example, released a report titled GenAI: Too Much Spend, Too Little Benefit, which served as a cautionary tale across Wall Street. Yet, at the same time, Leopold published a detailed 165-page blog post outlining the true state of AI in 2024 and its trajectory. His thesis was clear:

"The AGI race has begun. We are building machines that can think and reason. By 2025 or 2026, these machines will outpace many college graduates. By the end of the decade, they will be smarter than you or I. We will have super intelligence in the true sense of the word."

Leopold identified that while many were still dismissing AI as mere hype or a next-word prediction machine, the reality was far more transformative. Only a small group, mostly in AI labs around San Francisco, had what he called “situational awareness” — a deep understanding of the technological and economic changes underway.

Armed with this conviction, Leopold launched his hedge fund to capitalize on this insight. His strategy is straightforward yet powerful:

- Invest heavily in semiconductor infrastructure and power companies that will benefit from AI's growth.

- Allocate capital to promising AI startups, including a stake in Anthropic.

- Take short positions on industries likely to be disrupted or left behind by AI advancements.

This approach has paid off handsomely. In the first half of the year, the Situational Awareness fund returned 47% after fees, significantly outperforming the S&P 500’s 6% and tech hedge funds’ average of 7%. What makes this even more remarkable is Leopold’s lack of prior professional money management experience, underscoring the value of deep AI knowledge and conviction in today’s market.

AI-Themed Funds: A New Wave or a Fading Trend?

Leopold is not alone in launching AI-focused funds. The Wall Street Journal has reported several other hedge funds riding the AI wave, though none have matched Leopold’s exceptional performance. The rise of thematic funds focused on AI mirrors past trends, such as the proliferation of ESG (Environmental, Social, and Governance) investment funds reacting to client demand.

However, it’s crucial to understand the differences between these themes. Many ESG funds struggled because their investment ideas were often tied to external subsidies or carbon market arbitrage rather than fundamentally transformative technologies. This mismatch led to poor performance and many funds shutting down.

In contrast, AI represents a much larger and more tangible economic shift. Funding for AI startups has exploded, with companies like Anthropic even turning to sovereign wealth funds from the Middle East to secure the scale of investment required. The U.S. venture capital ecosystem, while still interested, lacks the capacity to fund these ventures at the necessary scale.

The Market's Limited Ways to Play AI and Emerging Strategies

Despite the excitement, Wall Street currently has limited avenues to directly invest in the broad AI ecosystem. Much of the capital is focused on infrastructure buildout—particularly data centers and semiconductor companies—which is understandable given the massive demand for AI compute power.

A recent Bloomberg chart showed that spending on data center construction nearly matches that of general office construction in sheer dollar terms, highlighting the scale of the AI infrastructure boom. Investing in this space makes sense, but it’s only one piece of the puzzle.

Wall Street traders are also becoming increasingly creative in how they play the AI theme. Beyond buying AI-related stocks, many are shorting companies they believe will be negatively impacted by AI disruption. Bank of America recently published a list of 26 companies at the highest risk, and surprisingly, these are not outdated legacy firms but rather tech companies that thrived in the past decade. Examples include:

- Wix, a web development firm

- Shutterstock, a stock image company

- Adobe, a software conglomerate

These companies have collectively underperformed the S&P 500 by 22 percentage points since mid-May 2024, signaling investor concerns about AI’s disruptive potential.

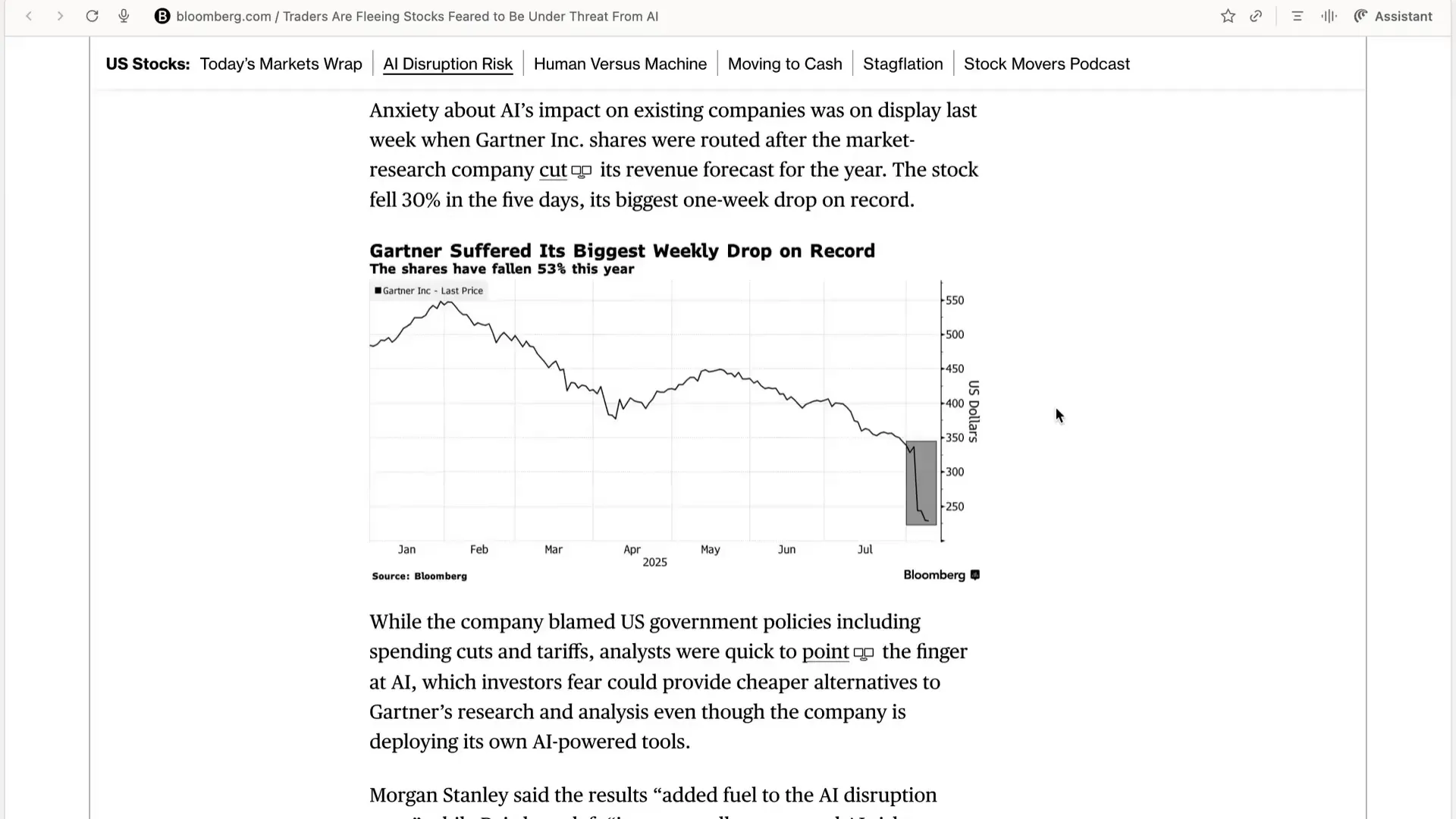

Gartner, a research and advisory firm that relies heavily on proprietary data and in-depth analysis, is another example facing AI disruption fears. After cutting revenue forecasts, its stock experienced a 30% drop in five days—the largest weekly decline on record—and has since lost half its value this year. Morgan Stanley noted that the results “added fuel to the AI disruption case.”

AI Agents For Recruiters, By Recruiters |

|

Supercharge Your Business |

| Learn More |

Why AI Disruption Is Different and What It Means for the Market

Any company paying humans to perform tasks that AI can do faster and cheaper is at risk of being wiped out or radically transformed. While previous technological revolutions like the PC boom and the internet caused disruption, the pace was slower and more gradual.

Phil Furst, CEO of HFS Research, remarked that we are entering uncharted territory where entire industries could be threatened simultaneously. This creates a tough, unforgiving market environment with high volatility and rapid shifts.

Given this context, many investors are on the lookout for signs of an AI bubble. However, applying historical analogies to the AI market is challenging and often misleading.

Debunking the AI Bubble Narrative: A Closer Look

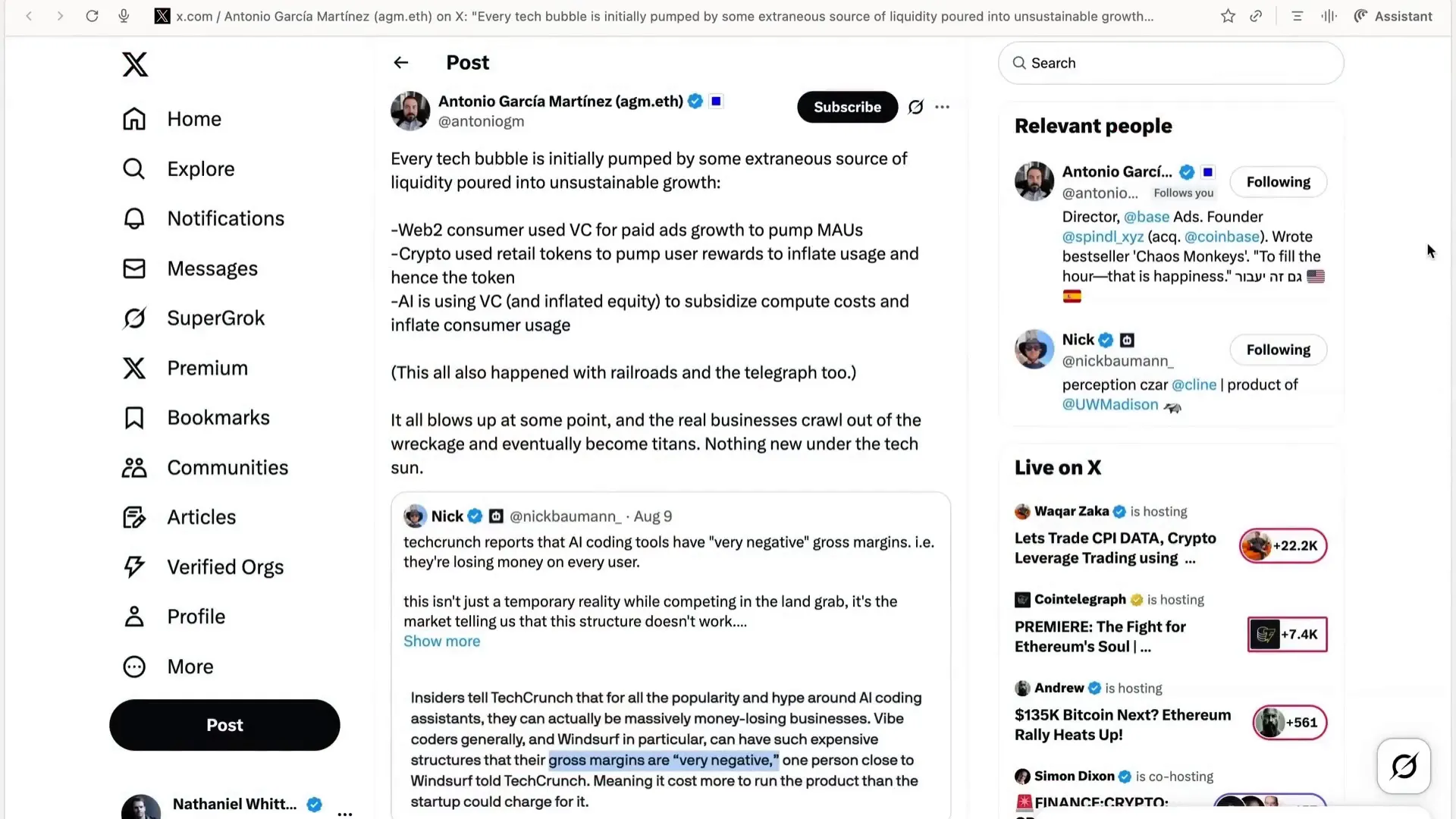

Some critics argue that AI’s current market structure resembles past tech bubbles, where external capital subsidizes unsustainable growth. Antonio Garcia Martinez, a respected commentator, pointed out that:

"Every tech bubble is initially pumped by some extraneous source of liquidity poured into unsustainable growth. Web 2 consumer used VC for paid ads growth to pump MAUs. Crypto used retail tokens to pump user rewards to inflate usage and hence the token. AI is using VC and inflated equity to subsidize compute cost and inflate consumer usage."

While this perspective highlights important points about capital flows, it oversimplifies the unique dynamics of AI. Unlike Web 2.0 platforms, where monthly active users didn’t guarantee revenue and depended heavily on advertising models, AI platforms like ChatGPT have achieved unprecedented user adoption—700 million users in just two and a half years.

Moreover, the growth in usage is not just a result of artificially low prices subsidized by investors. For example, coding platforms might currently operate at negative gross margins, but that is because customers demand as much AI-powered assistance as possible, not merely because it’s cheap. Developers are employing complex workflows that involve multiple AI agents working in the background simultaneously, driving token usage to new heights.

To illustrate, Google’s token processing jumped from 480 trillion in May to 980 trillion in July 2024—a staggering 104% growth in just a couple of months.

The cost of AI inference has also dropped dramatically, contrary to some earlier predictions. Companies like Replit have shifted from charging per completed request to charging based on compute time, boosting their margins and reflecting a maturing business model.

The Future of AI Investing: Generational Shifts and Market Realities

One intriguing aspect of the AI investment landscape is the emergence of young, tech-savvy investors who possess “situational awareness” about AI’s transformative potential. Young Macro, a notable commentator, predicts that capital management will soon be dominated by “chronically online zoomers,” a generational shift reminiscent of the late 20th century’s entrepreneurial booms.

While it remains uncertain whether hedge funds like Leopold’s Situational Awareness will maintain their spectacular performance, the broader market is likely to adapt and embrace AI more fully over time.

For now, AI markets are exuberant and moving full steam ahead, driven by genuine technological progress and shifting economic paradigms. The debate over whether this constitutes a bubble or a new era of innovation is sure to continue, but one thing is clear: AI in recruiting and other sectors is reshaping how we think about technology, investment, and the future of work.

Conclusion: Navigating the AI Revolution with Insight and Caution

The AI revolution is unfolding in complex and unprecedented ways. While excitement and investment flows are soaring, it’s crucial to avoid simplistic comparisons to past bubbles that fail to capture the unique characteristics of AI technology and its market dynamics.

Understanding the nuanced perspectives of experts, recognizing the real economic shifts underway, and appreciating the challenges of integrating AI into traditional industries are key to making informed decisions in this rapidly evolving landscape.

As AI continues to influence recruiting, finance, and countless other fields, staying informed and engaging in thoughtful dialogue will be essential. Whether you view the current AI market as a bubble or a breakthrough, its impact is undeniable and worth close attention.

Let’s embrace this moment with both enthusiasm and critical thinking, ready to adapt to the exciting future AI promises.